Sin City is alive with technology this week.

The Consumer Electronics Show has taken over the town, and some of the most exciting tech companies on the planet are here.

Yet, despite all the latest and greatest gadgets that are on display, the only thing anyone can seem to talk about is where they’re getting their weed.

So many out-of-towners aren’t used to it yet, but in Nevada, you can walk into any number of dispensaries and legally buy cannabis.

This year there are nearly 200,000 people attending the Consumer Electronics Show in Vegas. And I’m willing to bet that more than half of them have spent a fair amount of their per diems on marijuana.

Of course, this should come as no surprise to you.

Back in August I told you how Nevada would quickly become one of the most lucrative cannabis markets in the U.S., primarily due to the steady flow of visitors it receives every day.

In 2016, 42.9 million people visited Las Vegas. This year, that number is expected to soar past 50 million.

Couple that with the 633,000 residents of Las Vegas — more than 40% who likely purchase and consume cannabis on a regular basis — and you have the recipe for one hell of an investment opportunity.

It Ain’t Rocket Science

Last year, it was predicted that Nevada would do $30 million in cannabis sales for 2017.

In October alone, the Silver State did $37.9 million.

When the final 2017 numbers come in, it’ll be well over $100 million. And remember, Nevada only began allowing for the sale of recreational cannabis in July.

Look, it ain’t rocket science.

This is, hands down, one of the most lucrative markets in the United States.

I’m actually still surprised that so many investors continue to ignore the legal cannabis market.

Especially after last week.

How to Get Rich in the Legal Cannabis Market

Last week, Attorney General Jeff Sessions rescinded an Obama-era policy that basically disallowed federal prosecutors from going after cannabis businesses operating in states where it has been legalized.

You see, the U.S. Attorney General is a very outspoken critic of legalization and continues to do whatever he can to stop the continued momentum we’ve been witnessing in this space. But what he and a lot of other folks fail to realize is that this momentum simply cannot be stopped.

If you need any proof, just look at how cannabis stocks reacted to Sessions’ announcement last week.

The second the news came out, cannabis stocks sold off in a major way. But I knew it was merely a blip, because that announcement didn’t matter.

The truth is, there are few federal prosecutors who have the staff, resources, or even desire to go after these cannabis operations. Moreover, in the states where cannabis has been legalized, governors, mayors, and other local politicians are enjoying the windfall of tax revenue that has accompanied legalization.

Say what you want about politicians, but nothing motivates these guys more than state and local tax revenue. And they’re not giving that up for anyone.

Insiders knew the sell-off would be brief, so we started buying in large chunks. I also told members of my Green Chip Stocks community to use that opportunity to pick up some cheap shares of a few quality cannabis stocks.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

One in particular was Innovative Industrial Properties (NYSE: IIPR).

Following Sessions’ announcement, shares of IIPR fell about 16%. But I didn’t flinch. This was a buying opportunity if I ever saw one. So I screamed from the rooftops: Buy the dip!

Here’s how that worked out…

As anticipated, the stock bounced back, closing out the next day at $29.42.

That’s a 16.8% gain in one day.

And that, dear reader, is just one of many that we took advantage of after Jeff Sessions made his announcement.

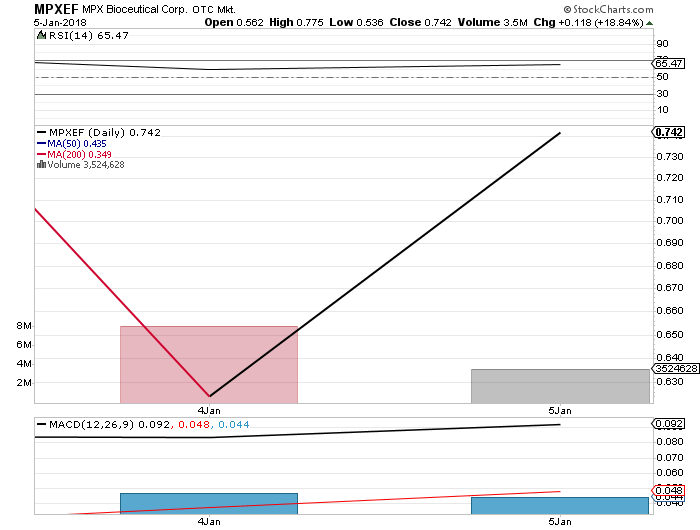

Another stock I told folks to pick up on the dip was MPX Bioceuticals (CSE: MPX)(OTCBB: MPXEF). That stock fell by about 12% on the day all those cannabis stocks sunk. Those who listened to my advice and picked up MPX on the dip enjoyed a 15.6% gain the next day.

Of course, I’ve been singing the praises of MPX Bioceuticals for a long time. I even highlighted it in my October 3, 2017, issue of Energy and Capital. The stock was trading at about $0.36 that day. Had you bought it on my recommendation, you would’ve already more than doubled your money.

$20,000 back in October is now worth nearly $50,000.

That, dear reader, is how you get rich in the legal cannabis market!

Of course, while I told you about MPX back in October, I told members of my Green Chip Stocks community even earlier, thereby allowing them to make even more money. Indeed, membership to Green Chip Stocks does have its privileges.

Just take a look at our portfolio:

Nearly every stock in this portfolio is a cannabis stock, and I’m adding more as we head into 2018 — which many insiders believe will be the biggest year for cannabis stocks yet.

One of those stocks has exposure to the Nevada market, too. Just like MPX Bioceuticals. But it’s still flying under the radar, which means it’s time to pounce.

You can get a piece of this action, too, by becoming a member of Green Chip Stocks today.

Once you sign up, you’ll also get a free copy of my best-selling e-book, “A Beginner’s Guide to Cannabis Investing.” Plus, you’ll get my next pot stock recommendation, which we’ll soon be adding to our portfolio of triple- and quadruple-digit winners.

I plan on releasing this new recommendation in less than two weeks, so if you want in, you need to lock in your membership now.

Or you can just sit on the sidelines while the rest of us get rich.

To a new way of life and a new generation of wealth…

Jeff Siegel

Jeff is an editor of Energy and Capital as well as a contributing analyst for New World Assets.

Want to hear more from Jeff? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@JeffSiegel on Twitter

@JeffSiegel on Twitter